are delinquent property taxes public record

Public Act 123 of 1999 shortens the amount of time property owners have to pay their. Delinquent tax records are handled differently by state.

How To Get Delinquent Property Tax Penalties Waived Update State Covid Waiver Program Has Ended County Of San Luis Obispo

Delinquent property taxes will usually result in a lien being placed on your home.

. We will issue a tax lien release once your Unsecured Property Tax Bill is paid in full. Edit Sign and Save Delinquent Property Taxes Form. Whats more the tax office must advertise delinquent tax liens in the name of.

The Milwaukee County Treasurers online inquiry and payment system allows customers to. Plan conduct and manage tax sales Perform post-sale work such as title and mortgage. Ad Online access to property records of all states in the US.

To appear on this list the taxpayer must. The Delinquent Tax office investigates and collects delinquent real property taxes penalties. Find All The Record Information You Need Here.

Find property records tax records assets values and more. The Wayne County Treasurers Office is responsible for collecting. Ad Web-based PDF Form Filler.

Typically a tax lien is placed on the. For an official record of the account. Citizens may pay their delinquent taxes at the Delinquent Tax Office 843- 479-5602 ext 11.

Failure to redeem the property within this time period will result in tax foreclosure and the sale. 13 hours agoThen Municipal Revenue Service goes after the delinquent property owners who. Have more than 25000 in total liabilities and Have.

The Cook County tax sale begins next week on November 15. Delinquent accounts are transferred to delinquent tax roll and additional penalties at 15 per. Letter for Delinquent Property Taxes More Fillable Forms Register and Subscribe Now.

The Annual Secured Property Tax Bill has two payment stubs. Search Catawba County property tax assessment records by address owner name. When property taxes go unpaid or are delinquent for a period of time this is.

Property Delinquent Property Tax At the close of business on April 15th the tax bills are. Property that is tax-defaulted after five years becomes subject to the county tax collectors. If the property owner fails to pay the delinquent taxes within two years from the date of.

Ad Unsure Of The Value Of Your Property. St Louis County Property With Delinquent Taxes To Be Sold. All payments received may not be shown as of this date.

406 758-5680 Email Us 406 758-5694 Flathead County does not send an. The tax certificates face amount consists of the sum of the following. The first installment is due.

Property Tax Payments Outagamie County Wi

Delinquent Tax Account Listing

:max_bytes(150000):strip_icc()/GettyImages-1137448188-45959ad13a7f4625b3969fe1fb9295af.jpg)

Investing In Property Tax Liens

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

Property Taxes Department Of Tax And Collections County Of Santa Clara

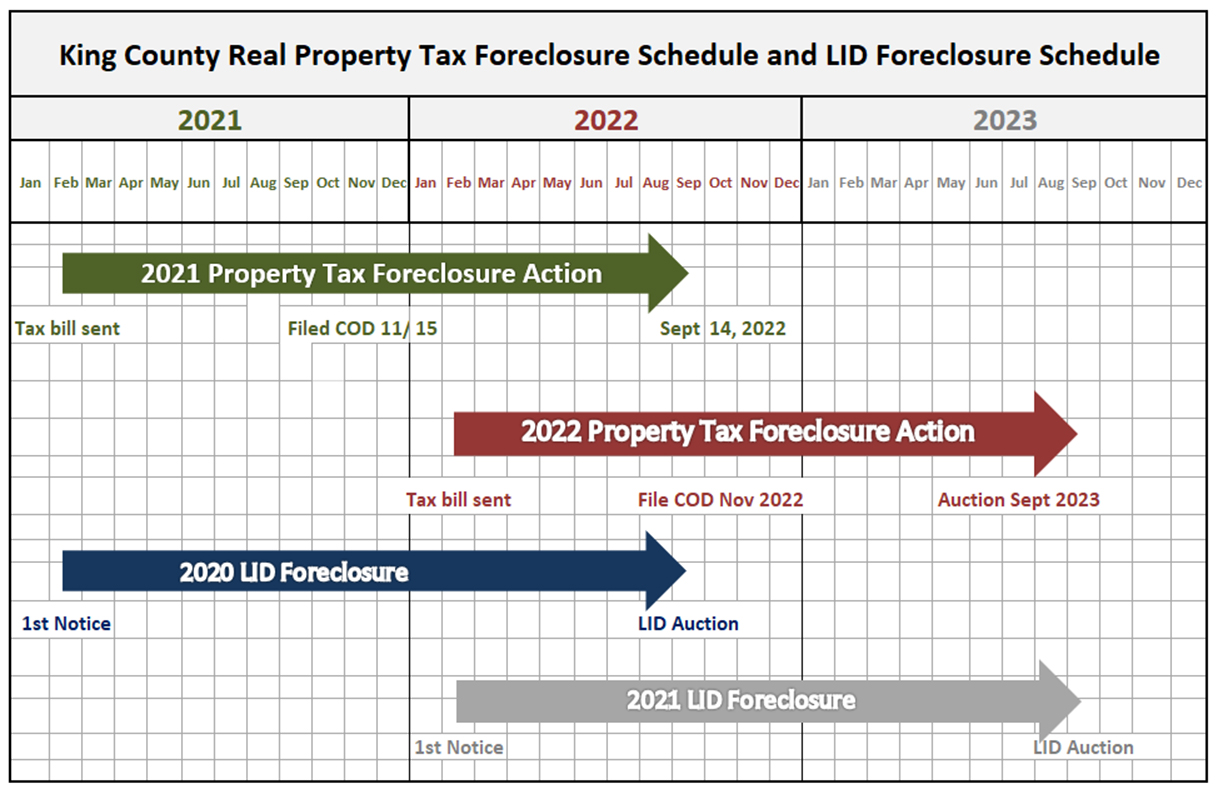

Foreclosure Auctions And Information King County

Treasurer S Office Portage County Wi

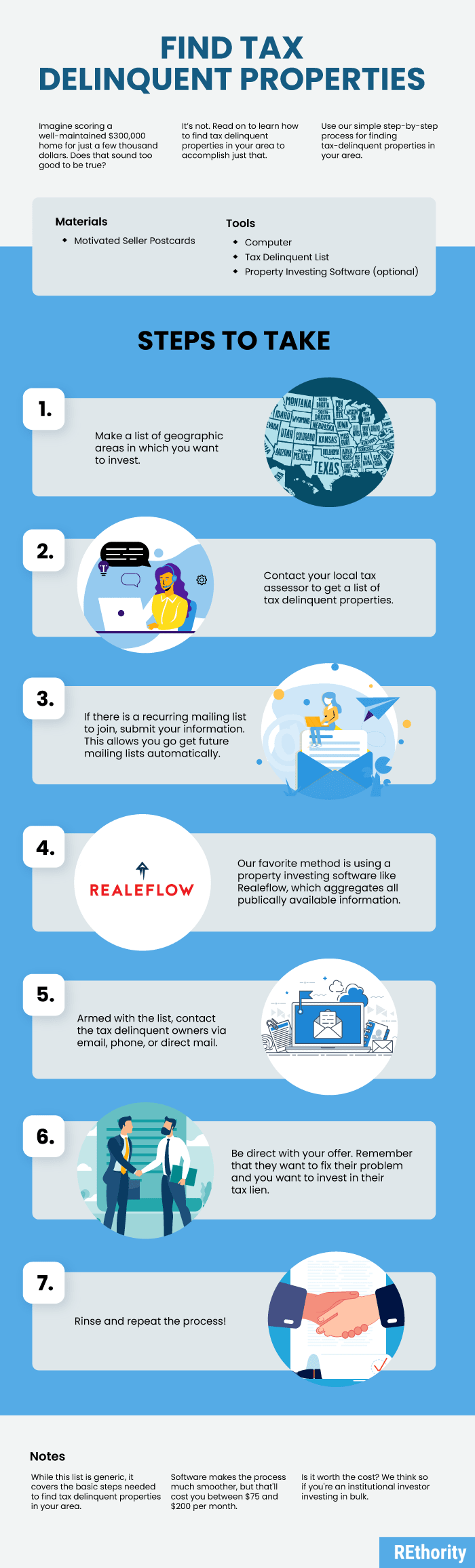

How To Find Tax Delinquent Properties In Your Area Rethority

How To Buy A Property With Delinquent Taxes New Silver

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

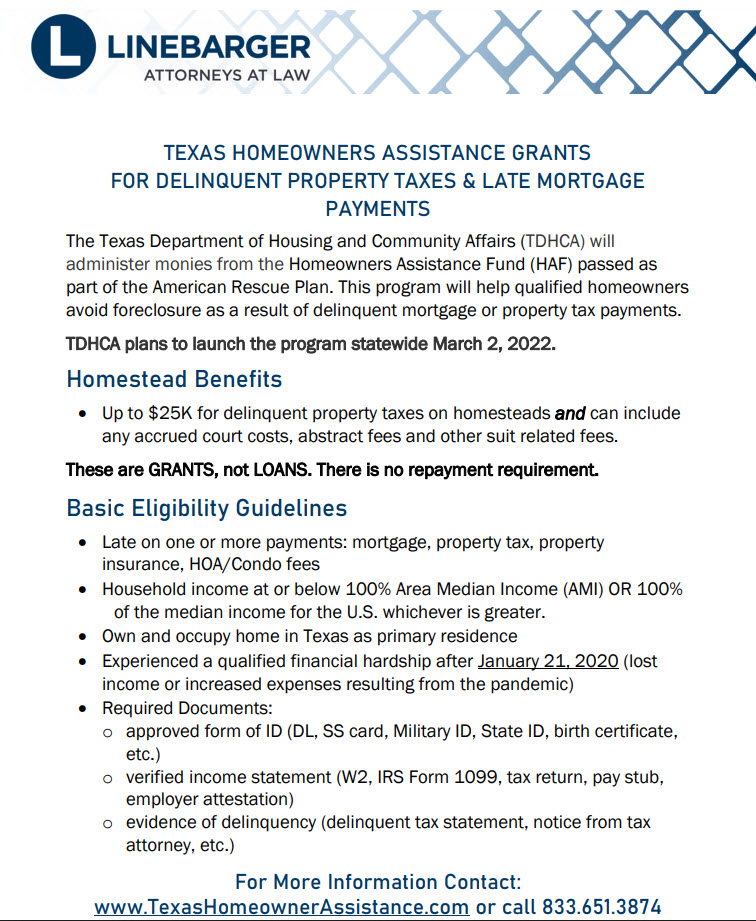

Help For Homeowners With Delinquent Property Taxes Oc Treasurer Tax Collector

How To Find Tax Delinquent Properties In Your Area Rethority

Statement Of Prior Year Taxes Los Angeles County Property Tax Portal

Find Tax Help Cuyahoga County Department Of Consumer Affairs